Shareholder Returns Policy株主還元方針

Shareholder Returns Policy

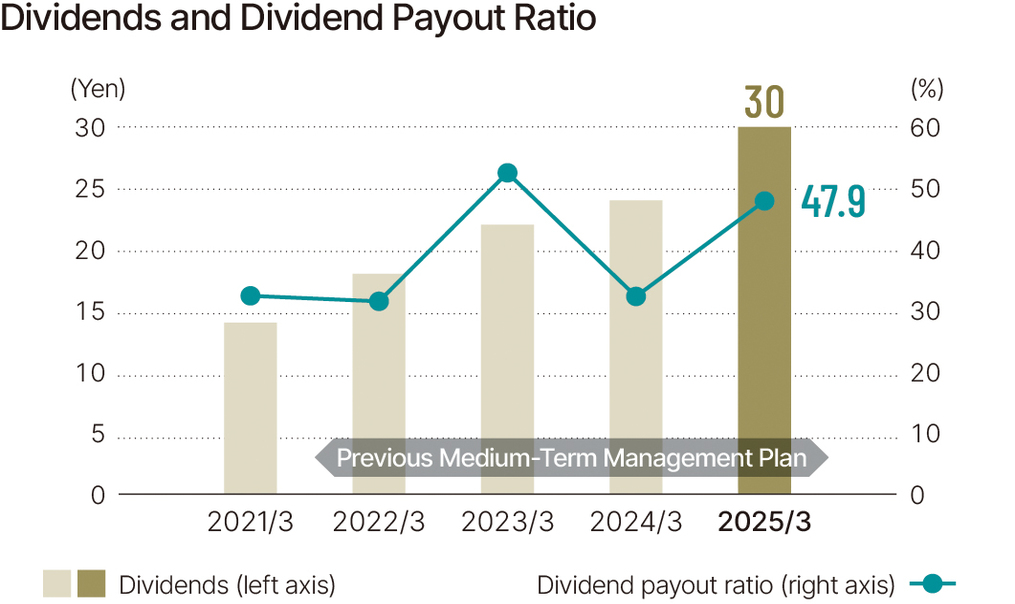

MIRARTH HOLDINGS The Group recognizes that returning profits to shareholders is one of the important management issues, and plans to return returns through stable dividends while implementing a growth-oriented use of cash. For the fiscal year ending March 2025, the dividend payout ratio was 30 yen per year, with an interim dividend of 7 yen and a year-end dividend of 23 yen, and a dividend payout ratio of 47.9%. In the current medium-term management plan period, we have set a target of a dividend payout ratio of 35-40%. For the fiscal year ending March 2026, we plan to pay an interim dividend of 5 yen and a year-end dividend of 16 yen of 21 yen, with a dividend payout ratio of 35.7%. In addition, as a medium- to long-term strategy, we have set forth strengthening engagement with investors. We will continue to actively engage in dialogue with stakeholders so that shareholders and investors can understand our strategies to enhance financial soundness while being aware of stock prices. We look forward to your continued support to the Group