Business

Business: 01

Real Estate Business

New built-for-sale condominium

Business Overview

New built-for-sale condominium business is the core business, accounting for half of consolidated sales. The company's main brand is "LEBEN," a family condominium for first-time acquirers, with an average size of around 70 m2 and a floor plan centered on 2LDK and 3LDK. In addition, there is "Nebel," a compact condominium for singles and DINKS, and "The LEBEN," which realizes a high-average home through the pursuit of quality. Through an integrated system from land acquisition to product planning, sales and management, we create customer-oriented products.

Review of the fiscal year ending March 2024 and progress of the medium-term management plan

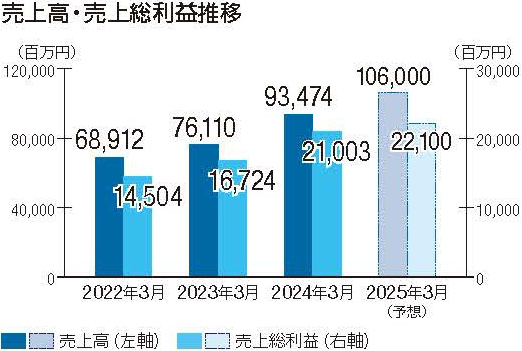

New built-for-sale condominium In the fiscal year ended March 2024, net sales were 93,474 Millions of yen (up 22.8% year-on-year), gross profit was 21,003 Millions of yen (up 25.6% year-on-year), and gross profit margin was 22.5% (up 0.5 percentage points year-on-year). It accounts for 50.5% of consolidated net sales and 51.7% of gross profit, and remains the mainstay of Real Estate Business.

The number of units sold in New built-for-sale condominium was 2,214, an increase of 353 units from the previous fiscal year, and progress was in line with the plan. By strengthening our brand, we were able to close the contract smoothly and maintain a high profit margin.

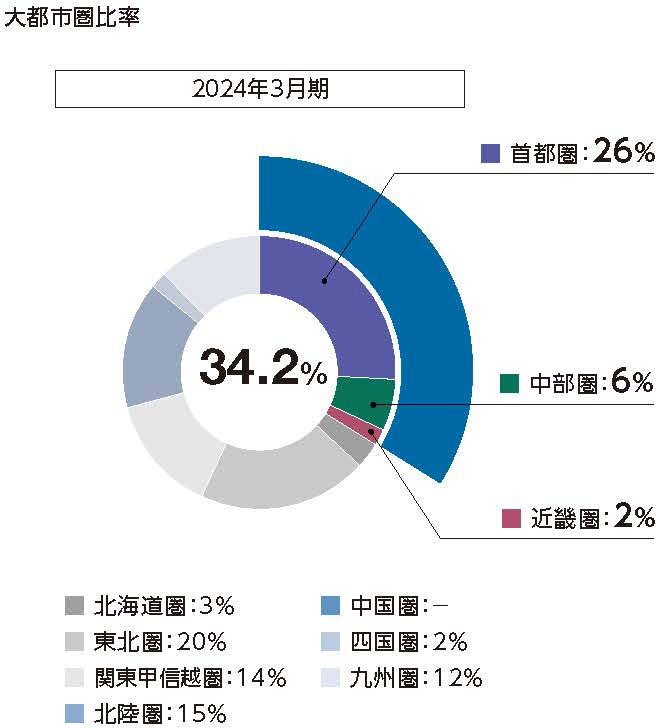

The sales area was from Hokkaido to Kyushu, and the sales ratio by region was 26% in the Tokyo metropolitan area, 6% in the Chubu region, and 2% in the region. Together, the ratio of sales in metropolitan areas was 34.2% (down 14.6 percentage points from the previous fiscal year), and the ratio of sales in regional cities was high in the fiscal year under review.

Our main customers are dual-income households in their early 30s ~ mid-40s. The average selling price per unit was 42.2 Millions of yen (up 3.2% year-on-year).

Future Initiatives

New built-for-sale condominium Although the number of units sold is decreasing, the average price is on an upward trend both in the Tokyo metropolitan area and nationwide. The supply-demand balance is favorable due to low interest rate measures and an increase in the number of dual-income households, and sales are continuing to be strong in the fiscal year ending March 2025. Of the 2,200 units scheduled to be delivered, 1,353 units, or approximately 62%, have already been contracted at the beginning of the fiscal year, and sales and profits are expected to increase by 106,000 Millions of yen and gross profit of 22,100 Millions of yen. The average selling price per unit is 48.2 Millions of yen, an increase of 14.2%.

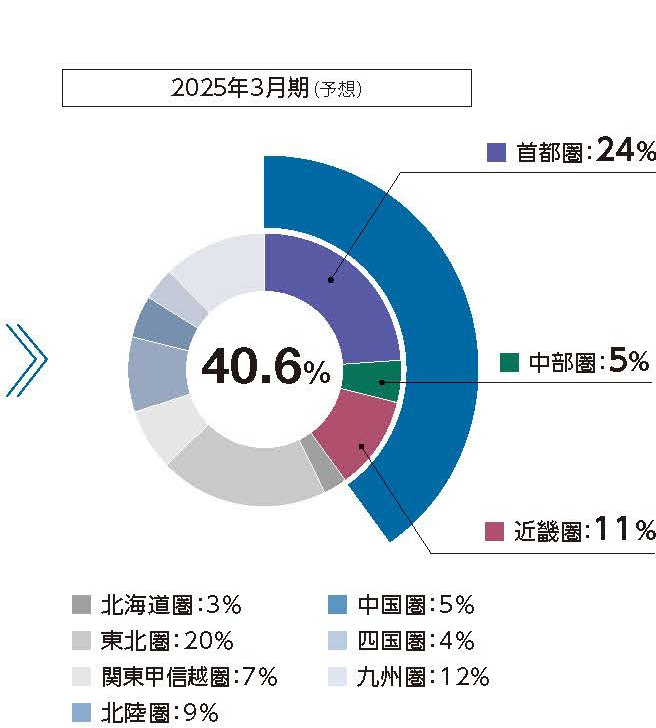

The ratio of metropolitan areas is expected to be 40.6% (up 6.4 percentage points), and we will continue to purchase land with a focus on convenient locations in regional central urban areas and suburban areas, which are our strengths, while keeping 50% in mind. We aim to maintain a system to provide a stable supply of properties nationwide, and to provide a stable supply of 2,000 to 2,200 units per year, while assessing the external environment, such as the prolongation of the construction period and soaring construction costs.

We aim to increase our competitiveness and achieve sustainable growth by promoting cost control through an integrated system from land purchase to sales and productivity reform through DX and other measures, and by supplying high-value-added condominiums in attractive locations.

Liquidation

Business Overview

New built-for-sale condominium It is the second pillar after the business, and we develop rental housing, office buildings, hotels, etc., and sell them to real estate funds on a one-by-one basis. Of the properties we have developed so far, 6~7% have been sold to Takara Leben Real Estate Investment Corporation, and we also play a role in supporting the corporation.

Review of the fiscal year ending March 2024

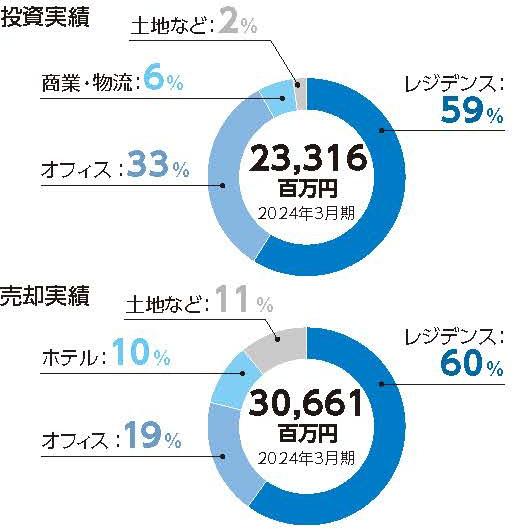

In terms of investment amounts, due to more carefully selected purchases and an increase in the number of development projects compared to existing real estate, the amount of investment was only 23.3 billion yen against the target of 30.0 billion yen. By real estate type, 59% were residences, 33% were office buildings, 6% were commercial and logistics facilities, and 2% were land.

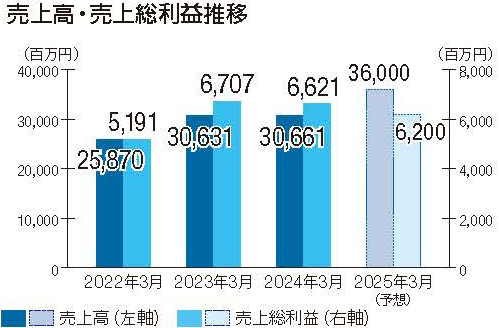

In terms of sales, 30,661 Millions of yen properties were sold, with 60% for residences, 19% for offices, 10% for hotels, and 11% for land. The gross profit margin was 21.6%, which was higher than the initial plan, and stable profits were recorded. This is due to the continued strong market and the significant contribution of newly developed residences and other factors to the profit margin.

Future Initiatives

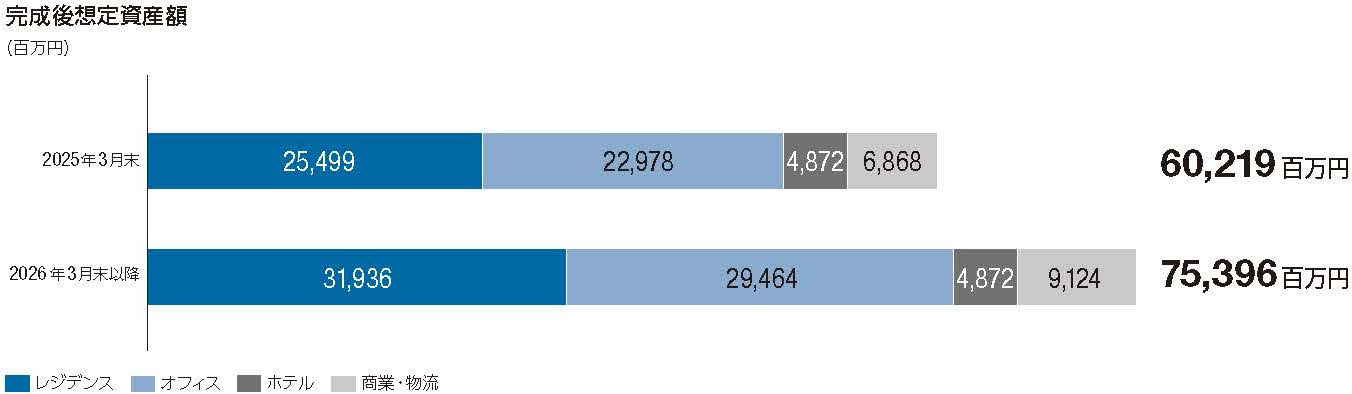

Currently, we are actively developing new residences for REITs, and development projects accounted for approximately 95% of our profit structure in FY2023. In the future, we will continue to invest at a pace of 300~50 billion yen (purchase of properties) and accelerate the development of new residences, which are our specialties, while carefully selecting investment destinations. In addition, in light of rising construction costs and longer construction periods for development projects, we will also invest in projects that increase the value of existing real estate as short-term recovery projects. In the fiscal year ending March 2030, we aim to reduce the value increase to 20% of our profits and the development project to 80%.

Liquidation In our business, we take advantage of synergies with the condominium sales business and repurpose our nationwide network. If there is a profit opportunity for a property with an investment amount of 500 million yen or more, I try to consider it. We have accumulated information from the network that extends to such regions, and we will proceed with business development.

For the fiscal year ending March 2025, the company expects revenue to increase 17.4% q-o-q to 36,000 Millions of yen, while gross profit is down 6.4% to 6,200 Millions of yen and gross profit is down 4.4 percentage points to 17.2%.

New detached house

Business Overview

Utilizing its know-how in the condominium business, Leben Home Build develops, plans, and sells detached condominiums "LEBEN Platts" that are particular about "light, water, and air." We pursue quality and design that aims to improve the value of the city and design from the perspective of the residents. In addition, we are expanding the scope of our business by developing the "Land Effective Utilization Business," which consistently undertakes everything from proposals for effective use of land to design and construction (construction contracting) and operation management and maintenance after the completion of the building.

The standard scale of one project is 10 units or less, and the floor plan of the house is mainly 4LDK. The customer base is households in their 30s ~ mid-40s, which is the primary housing acquisition group.

Review of the fiscal year ending March 2024

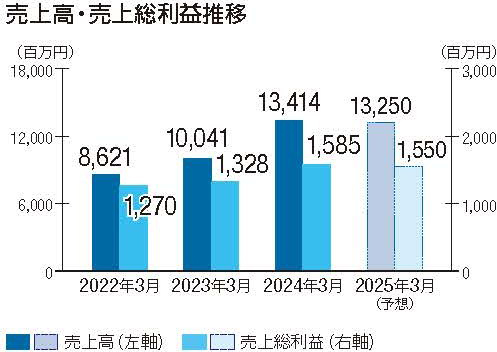

Due to the deep-rooted demand for detached houses, sales have progressed steadily. The number of units sold was 222 units, which was an increase of 33 units from the previous fiscal year, although we did not achieve the initial plan of 240 units. Gross profit was 1,585 Millions of yen and the gross profit margin was 11.8%, achieving the initial plan. The average selling price per unit was 60.4 Millions of yen, up 13.7% from the previous quarter.

Future Initiatives

In the fiscal year ending March 2025, the number of units sold is 230 units, an increase of 8 units from the previous fiscal year. Sales are expected to be broadly flat at 13,250 Millions of yen, gross profit of 1,550 Millions of yen, and gross margin of 11.7%.

Currently, the profit margin is on a downward trend, so we will aim to improve the profit margin by reducing costs, including SG&A expenses. In light of rising construction costs and still fierce competition for land purchases, we do not intend to significantly increase the number of units sold, but rather plan to rotate in a short period of time while maintaining a stable inventory equivalent to twice the number of units sold annually. The target period from purchase to sale (delivery) of land for detached houses is six months, and even for larger projects and projects where sales competition is severe, it is targeted to be within one year. In addition, we will work to determine the balance between supply and demand and rebuild our purchasing and sales systems by strengthening area marketing by carefully selecting purchasing areas.

Renewal resale

Business Overview

We purchase used apartments, etc., averaging 60m2 and built around 30 years ago, for rent, mainly in Tokyo, Chiba and Chiba prefectures, and resell them after increasing the value of the apartments once the tenants have moved out. The rent generated until the tenants move out is also an important source of income. We mainly buy and sell on a per-room basis, but there are also cases where we buy entire buildings and sell them under the "Le Halle" brand.

Review of the fiscal year ending March 2024

As some bulk sales of multiple properties were shifted to the next fiscal year, net sales of 7,875 Millions of yen, gross profit of 1,041 Millions of yen, and sales of 202 units were all short of the plan. As with New built-for-sale condominium, the second-hand market has seen prices rise, resulting in a gross margin of 13.2%, higher than the initial plan of 11.8%.

Future Initiatives

In order to better capture latent demand for pre-owned condominiums and establish a stable renewal business cycle, we will form a dedicated purchasing team and actively develop a business in which we purchase each building individually and then sell them under the "Le Halles" brand.

Real estate rental

Business Overview

About 90% of the properties we own are inventory properties in the Liquidation and Renewal resale businesses, and the main revenue is the rent generated from them. About 10% of the properties are intended for long-term holding. New built-for-sale condominium Utilizing the network in rural areas that we have acquired through our business, we have acquired rental properties such as residences and offices throughout Japan to secure stable earnings. Tenant acquisition operations for rental real estate owned by Group companies are mainly carried out by Leben Trust Group companies.

Review of the fiscal year ending March 2024

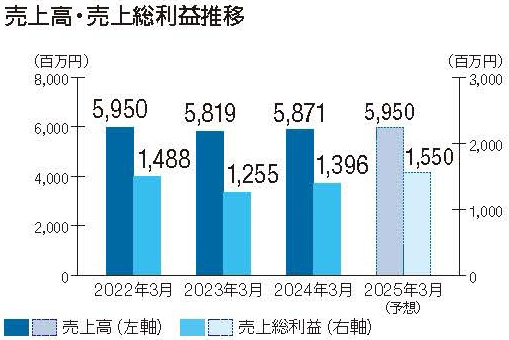

Although we were unable to achieve our initial plan, net sales were 5,871 Millions of yen, up 0.9% year-on-year, and gross profit margin was 23.8%, up 2.2 percentage points year-on-year.

Future Initiatives

We will steadily build up as a stock-fee business and aim to maintain a holding yield of 5.5% or more. We will build a portfolio centered on residences and offices. For the fiscal year ending March 2025, we plan to increase year-on-year to net sales of 5,950 Millions of yen and gross profit margin of 26.1%.

Real estate management

Business Overview

We mainly manage condominiums for sale, and we manage not only condominiums sold by the MIRARTH HOLDINGS Group, but also condominiums of other companies. Leben Community, a group company, conducts business.

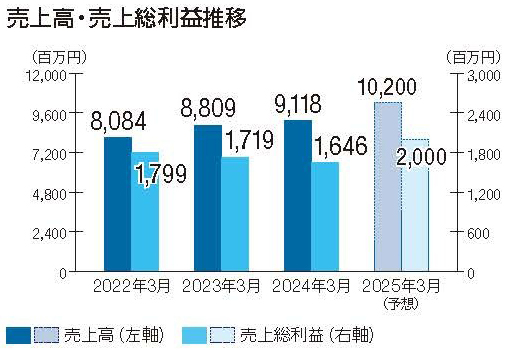

Review of the fiscal year ending March 2024

The profit margin is on a slight downward trend due to rising labor costs and other factors. The number of units under management was 76,661, sales were 9,118 Millions of yen, and the gross profit margin was 18.1%, none of which met the initial plan.

Future Initiatives

As labor costs are expected to continue to rise, we will work to reduce costs and review administrative expenses to improve profitability. Negotiations with the management association are generally progressing smoothly, and we will continue to negotiate price increases as the contract dates for each property arrive. In the fiscal year ending March 2025, we will increase the number of units under management by 3,339 from the previous fiscal year to 80,000 units, aiming for net sales of 10,200 Millions of yen and a gross profit margin of 19.6%.

Real estate Other

Business Overview

This business acts as an intermediary between customers and brokers for property sales and purchases. We are strengthening our real estate distribution business by utilizing properties supplied by our group for sale, management, and rental.

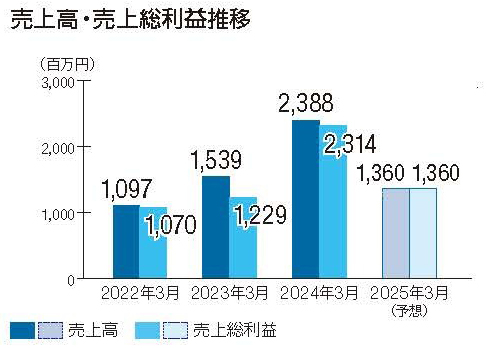

Review of the fiscal year ending March 2024

Net sales were 2,388 Millions of yen, up 55.2% year-on-year, and gross profit margin was 96.9%, up 17.1 percentage points year-on-year, significantly exceeding the initial plan.

Future Initiatives

In addition to expanding the development of stores mainly in the "LEBEN" property supply area, we will also strengthen the corporate brokerage function to build up as a stock-fee business. For the fiscal year ending March 2025, we plan to increase sales by 3.1 percentage points year-on-year to 1,360 Millions of yen, while gross margin is 100.0%, up 3.1 percentage points year-on-year.

Business: 02

Energy Business

Business Overview

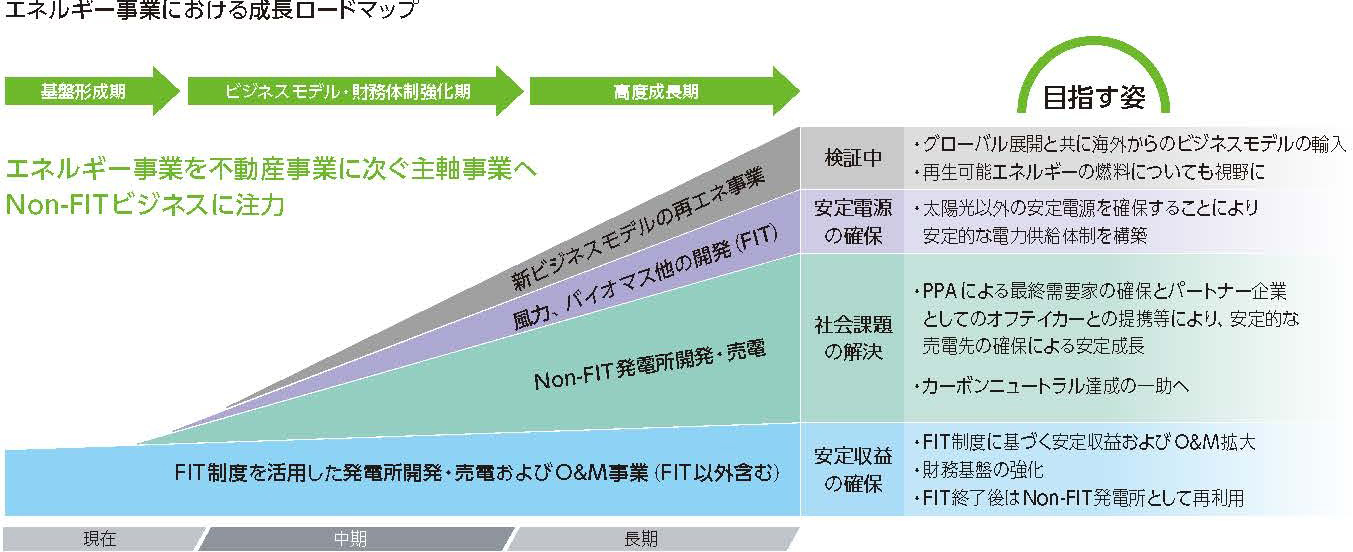

Focusing on MIRARTH Energy Solutions, we will sell electricity generated using renewable energy to electric power companies to earn stable income, and by generating renewable energy, we will play a role in contributing to society by stabilizing the power supply. We are working to build a business model that does not rely on the Feed-in Tariff (FIT), and we handle renewable energy such as solar, wind, and biomass power generation, as well as biomass fuel conversion using cashew nut shells. By diversifying our business portfolio, we will contribute to a Sustainability future.

The Group's Strengths and Business Model in Energy Business

Since 2013, MIRARTH HOLDINGS has been actively developing FIT-compatible solar power plants, but since the FIT purchase period that began in 2012 is gradually ending, we are working to convert to non-FIT. One of our strengths is our Power Purchase Agreement (PPA). While a FIT is a system in which an electric power company purchases electricity at a fixed price, a PPA is a contract to purchase electricity with a company or other consumer. Although it is necessary to go through retailers, etc., there is an advantage that you can become a price maker because you can negotiate directly with customers. There are "on-site PPAs" in which solar power generation facilities are installed on the premises of the customer, and "off-site PPAs" in which solar power generation facilities are installed outside the premises and sent through the general power transmission and distribution network.

However, if we make purchase contracts with each consumer and develop power plants, the speed will be slow. Therefore, in off-site PPAs, we secure off-takers in each power district who will purchase electricity if we develop them, and we are building a foundation for business development without slowing down development. We have already signed off-taker contracts with major trading companies and power companies.

Review of the fiscal year ending March 2024 and progress of the medium-term management plan

In the fiscal year ended March 2024, the Power generation facilities that are already in operation were sold as planned, and in the sales of electricity, sales were 13,849 Millions of yen, up 53.1% year-on-year, despite the fact that we were unable to achieve the initial plan due to the implementation of partial output curtailments, bad weather, and repair costs. From the fiscal year ending March 2025, electricity sales will contribute to profits throughout the year as a stable stock business.

We are evolving our business portfolio and have set a target of increasing the ratio of operating income to Energy Business to 30% of the total by the fiscal year ending March 2030. In the fiscal year ending March 2024, it was 13%. At the same time, the target for Energy Business EBITDA for the fiscal year ending March 2030 was 45%, compared to 32% for the fiscal year ending March 2024. In the fiscal year ending March 2023, it was 10%, and we are making good progress.

According to Energy Business 's growth roadmap for the fiscal year ending March 2030 announced in May 2023, we expect further growth by diversifying our power generation sources such as wind power generation and biomass power generation, as well as the development and sale of non-FIT power generation in growth areas, as well as the O&M business, with "FIT system-based power plant development and sales and O&M business" as stable revenues. In addition, as a new business model, we are considering the development of a wide range of energy businesses, such as the production of biofuels and the use of storage batteries, with a view to global expansion. In 2024, we will start a biomass fuel conversion project using cashew nut shells in Cambodia. In Japan, we are developing a biomass power plant using wood chips in Nobeoka City, Miyazaki Prefecture.

In the Medium-Term Management Plan, we had set a target of a cumulative power generation capacity of 360 MW by the end of the fiscal year ending March 2025, but we have already achieved 360 MW of existing holdings and development. As a new target, we aim to accumulate 420 MW (* solar equivalent) by the fiscal year ending March 2030. As of the end of March 2024, we have secured a pipeline of approximately 56 MW of solar equivalent, including 36 MW for PPA projects, 8 MW for wind power, and 12 MW for biomass, and we will actively develop the pipeline to achieve our targets.

Business: 03

Asset Management Business

Business Overview

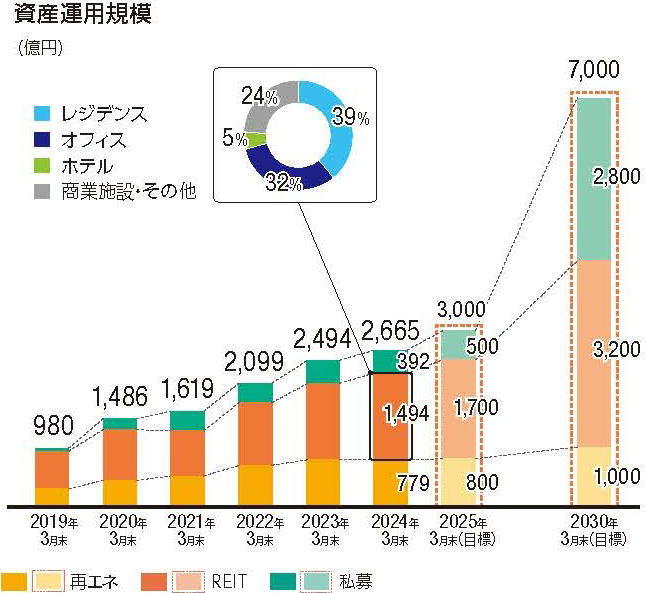

Utilizing the MIRARTH HOLDINGS Group's abundant expertise, know-how, and network in real estate and renewable energy, we are actively developing outsourced management of J-REIT and private funds. We provide a wide range of investors with blue-chip investment opportunities and solid wealth management services. These businesses are carried out by MIRARTH Asset Management and MIRARTH Real Estate Advisory.

Review of the fiscal year ending March 2024 and progress of the medium-term management plan

In order to shift to a stable stock-type business in which we hold Power generation facilities and earn income from the sale of electricity, we conducted a TOB for Takara Leben Infrastructure Fund, Inc., delisted it, and consolidated it. As a result, management fees are offset on a consolidated basis, resulting in a decrease in business revenues compared to the past. For the fiscal year ending March 2024, due to delays in the formation of a private placement fund, sales were 734 Millions of yen, falling short of the plan.

As for Takara Leben Real Estate Investment Corporation, we planned to accumulate assets of 170.0 billion yen by March 2025, but as of March 2024, it was 149.4 billion yen. We have been able to make stable contributions from sponsors, and we have been able to acquire properties that take advantage of the advantages of being a comprehensive type, and we are making good progress.

In terms of other acquisition prices, renewable energy was 77.9 billion yen and private funds were 39.2 billion yen, for a total of 266.5 billion yen.

Future Strategy

Each fund plans to build up assets. We anticipate an increase in acquisition and management fees associated with this, and we expect net sales to increase by 22.5% year-on-year to 900 Millions of yen. Japan continues to have low interest rates, and the yield gap between real estate returns and funding rates is wide, making it attractive to overseas investors and providing a tailwind. With regard to REITs, we will appropriately control costs and accumulate assets. By the end of March 2025, the final year of the Medium-Term Management Plan, we are targeting a total of 300 billion yen in asset management, which we believe is achievable.

In the future, we are considering expanding our Asset Management Business, and we are aiming for asset management of 700 billion yen in the fiscal year ending March 2030 as a medium- to long-term target. Going forward, we will continue to expand our Liquidation business, expand the scale of our assets, and contribute to the growth of the Group's stock-fee business.

Business: 04

Other businesses

Business Overview

The MIRARTH HOLDINGS Group is engaged in a wide range of businesses related to people's housing. In addition to the hotel business, which develops the hotel brand "HOTEL THE LEBEN" with the brand vision of ""Relaxation in everyday life, travel expands."," we are also engaged in the construction contracting business with thorough safety and health management by Leben Home Build and consideration for reducing environmental impact.

Review of the fiscal year ending March 2024 and future strategies

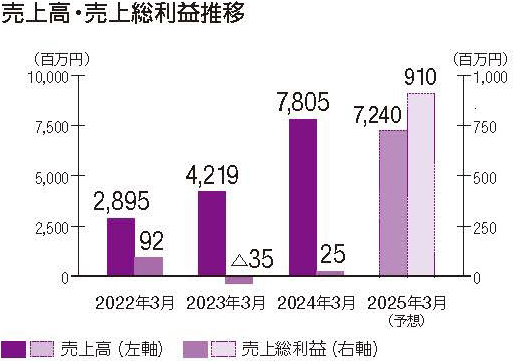

Revenue was 7,805 Millions of yen, up 85% year-on-year, mainly due to continued high hotel occupancy, but we were unable to meet our initial target. For the fiscal year ending March 2025, we plan to achieve a gross profit margin of 12.6% as hotel operations are expected to continue to have high occupancy rates and room rates. In December 2023, Takara Leben announced that it will develop and operate the Kagoshima Airport Hotel, which is adjacent to Kagoshima Airport, which closed at the end of March 2024, as a new hotel, Fun&Cool Hotel KAGOSHIMA Airport (tentative name), with the aim of opening at the end of 2026 (p. 55 "Value Co-creation with Customers and Local Communities: Regional Revitalization").

In the medium- to long-term, in addition to abundant inbound needs, we will strengthen the development of our own hotel brand that can capture domestic demand, and expand stock earnings in the hotel business through operation management and leasing schemes. In addition, with M&A in mind, we aim to operate 2,000 guest rooms in the fiscal year ending March 2030. In order to establish the hotel business as an independent segment, we are looking to expand the scale of the stock business through the non-asset business scheme.